Remember that we will never contact you and request personal or account information. Can I demand a substitute check from my bank instead of a copy? In some cases, the order of the checking account number and check serial number is reversed. x\oVG 8\ 88~F#v}F)U}M0d}$f&k6?n~YT}7lG?lc1L^O3V> A routing number is a nine digit code, used in the United States to identify the financial institution. The Atlanta Federal Reserve issued an alert to warn consumers to stay away from this scam.

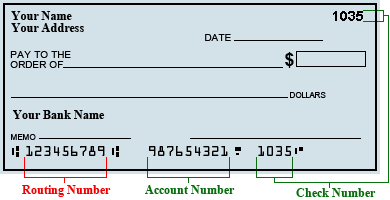

They can be financial and non-financial companies. Using BranchLine, our online banking service, click on Manage Profile, then Manage Alerts. To process checks, banks' automated check sorting equipment relies on numeric information that appears at the bottom of checks and is printed in magnetic ink. These three contact methods are being used in conjunction to help prevent unauthorized transactions on your debit and credit cards. Law enforcement, including the Federal Bureau of Investigation (FBI), is aware of this scheme, and individuals who participate in such schemes could also face criminal charges. With this information at your fingertips, it is important to keep your device up-to-date with the most current versions of virus protection and system software to ensure that your personal information is protected from unintended use. All deposit levels. Your money is protected with bank-level security. 4.65%. Check serial number - In exhibit B.3, the check serial number is outside the DAN field, and you can ignore The Federal Reserve has refuted such claims and confirmed it doesnt maintain accounts for individuals. No. The first three numbers corresponded to the location of the Social Security office that issued Banks must provide this disclosure to existing customers not later than the first statement mailing after Check 21 becomes effective on October 28, 2004. WebTheres an eight-year window, between ages 62 and 70, when you can start claiming Social Security retirement benefits. The Feds ongoing rate hikes were one of the catalysts for the bank failures, but that reality was not enough to get the central bank to tap the brakes. Create a PIN from a series of letters or words. The longer you wait, the larger your monthly payment will be. passwords, debit card numbers, and social security numbers. Account title - The name shown on the check should be preprinted or verified with the FI and must Under Check 21, banks are required to provide a disclosure to their consumer customers who receive canceled checks with their monthly statements.

Generally, any check can be used to create a substitute check, except a foreign check. NO SUCH LINKAGE EXISTS. The SSAN IS NOT LINKED to any bank, credit union, loan company, business, etc., etc., etc. You can open a savings, checking In addition to the above, you may also receive a phone call from our fraud department.

Today and every day, we put people before profits. For example, A41&14a is an easy-to-remember acronym for All for one and one for all.. Rather, when banks have agreed to provide paid checks in statements, Check 21 permits the bank to provide either the original check or a substitute check. The types of personal information we collect and share depend on the product or service you have with us. Average APY. <> In the alert, the Fed explains what happens if you fall for the scam: . If your bank is unable to determine the validity of your claim within 10 business days after receiving it, your bank on that day must refund the amount of your loss up to the lesser of amount of the substitute check or $2,500, plus interest (if your account earns interest). ;c8 la k_ k:XG=OT)xKhv}siJ,l>iC Q!G;GJnq\po How do I make a claim under the Check 21 refund procedure? https://leadstories.com/hoax-alert/2021/05/fact-check-social-security-card-is-not-credit-card.html, Fact Check: Video Does Not Show Personal Information On 'Dark Web' About People Who Had Taken COVID-19 Vaccine, Fact Check: Democrats Were Not 'Caught' Not Wearing Masks -- CDC Guidelines Allowed It, Verified signatory of the IFCN Code of Principles, Facebook Third-Party Fact-Checking Partner. The nine digits included on a Social Security card do not equate to a bank account number. Banks must also provide this disclosure when a consumer requests an original check or copy of a check and receives a substitute check. The Social Security Direct Express card is a prepaid debit card that allows you to use your Social Security benefits. : Marlo Lee is a fact checker at Lead Stories. While Social Security funds Mine is a Gso since G is the 7th letter in the alphabet, a one dollar bill that has a G seal is also the 7th FRB. Your bank's routing number is a nine-digit number that identifies your bank as a member of the American Bankers Association (ABA). Online Banking - Using online banking, you can securely access your accounts and view your real-time balances. Only click on links or download files (video and advertisements) that you are absolutely certain are from trusted sources. You would only have to remember one password.

The Federal Reserve Banks E-Payments Routing Directory provides basic routing information for Fedwire Funds Service, Fedwire Securities Service, and FedACH transactions. If your bank does not provide you with a substitute check, you usually can use a copy of an original check or a copy of a substitute check as your proof of payment. The red letters on the back of your social security card are routing numbers and your ss# is the account # the letter assigns it to the Federal Res That PIN is only generated when you initiate logging in to a system that requires it. You can use a substitute check as proof of payment because it is legally the same as the original check.

What protections do I have if I receive image statements, access pictures of my checks online, or receive an account statement with descriptive information about my canceled checks? You also may owe fees to your bank for returned or rejected payments.If you see ads that describes how you can pay bills using a Federal Reserve Bank routing number or account, report it to the Federal Trade Commission (FTC). bill payments being attempted using the Feds routing numbers are being rejected and returned unpaid. Spotted something? Protect yourself and your computer while using the Internet, by keeping your computers firewall turned on and keep your operating system, anti-spyware and anti-virus software up to date.

WebRocketreach finds email, phone & social media for 450M+ professionals. Federal Reserve Banks.

All deposit levels. How are image statements different from substitute checks?

All deposit levels. How are image statements different from substitute checks? If you do not have a substitute check but have a copy of an original check or a copy of a substitute check, you usually can use these documents as proof of payment. Individuals who attempt to pay bills or conduct other transactions using a Federal Reserve Bank routing number may face penalty fees from the company they were attempting to pay, or the suspension or closure of their commercial bank or payment service provider accounts, This is the case whether you receive an original check, a substitute check, an image statement, or a line item on your account statement. say "direct deposit." Search for Fedwire participants and for FedACH participant RDFIs with commercial receipt volume by name, location (state, or state and city) or routing number. This institution currently has 3 active branches listed. For information about our privacy practices, please visit our website. The first letter on the back of your ss-card is the letter that corresponds on the seal of the one dollar bill. If you suspect that someone knows your PIN, change it immediately.

866 234-5681. The routing number can be found on your Pacific Service Credit Union does not share with non-affiliates so they can market to you.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. You will notice a change only if you receive a substitute check when you were expecting an original check. Do not put dashes in the DAN unless the dash symbol is shown (see exhibit B.3.). Please select all the ways you would like to hear from Lead Stories LLC: You can unsubscribe at any time by clicking the link in the footer of our emails.

Its easy to set up alerts. Individuals who attempt to pay bills or conduct other transactions using a Federal Reserve Bank routing number may face penalty fees from the company they were attempting to pay, or the suspension or closure of their commercial bank or payment service provider accounts. Fact Check: The post purportedly shows a Social Security card from 1936 alongside one created more recently. How am I protected under Check 21? In that event, report the inquiry to the credit bureau. How will Check 21 make check processing more efficient? A recent hoax circulating on the internet asserts that the Federal Reserve maintains accounts for individuals that are tied to the individual's Social Security number, and that individuals can access these accounts to pay bills and obtain money. You might not have a check handy, however, so you can also call U.S. Bank at 800-872-2657 to find the routing number for your account. Your US social security number can never be linked to any specific Federal Reserve bank. You can use accounts at local banks in many/any different Pacific Service CUs electronic delivery channels are free, easy to use and can be a crucial component in data protection and fraud prevention. passwords, debit card numbers, and social security numbers. Please read this notice carefully to understand what we do. The following exhibits will show you where to find RTNs, DANs, or both on checks, Learn more about Mailchimp's privacy practices here. The Federal Reserve uses routing numbers to transfer money between banks, not customers. Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue N.W., Washington, DC 20551, Last Update: Social Security numbers are the skeleton key to identity theft. Passwords are important. Keep your computers firewall turned on. It is important to protect yourself and your computer while using the Internet. Interest rates can change and are partly affected by what the Federal Reserve is doing. Does Check 21 mean that customers can't get their checks back in their account statements? Banks, New Security Issues, State and Local Governments, Senior Credit Officer Opinion Survey on Dealer Financing We strongly caution you not to provide any information to those calling you claiming to be Pacific Service CU. Check 21 did not change these maximum hold times. Normally, you may withdraw your refund on the business day after your bank refunds your account. it. Just because a professional lives in your neighborhood or belongs to your networking group, it does not mean they are the best choice for what you need. Dont use the same password to access all of your online accounts. #@s\[`qz-!\PJH.-d If you receive canceled checks with your account statement but did not receive the required disclosure within the timeframes described above, please request one from your bank. The substitute check must also have been handled by a bank. meet the account title requirements in GN 02402.050. Since lenders are not making a lending decision or guaranteeing approval, these inquiries are typically considered promotional and wont affect your credit score. In order to have the necessary 9 digits for our

Bank ABA routing number; Bank account number; Type of account; You wont be able to make a payment with your account until you enter your information and EXAMPLE 3: The enrollment form has an ABM number of 123 and a Debit Card Number (Tarjeta de Dbito) of 4445556667778889. WebBasically, he's taking the routing number for the federal bank, and using the number on the back of his SSN card as an account number to pay for these things. If you dont touch your money by the end of the year, your account balance will be $2,040. 8*00fQ/F6?ld=t#gaHpA7Y Po,H@E@-tO))'^5\G06)" DBDz%z9hS\L"t August 06, 2013, Transcripts and other historical materials, Federal Reserve Balance Sheet Developments, Community & Regional Financial Institutions, Federal Reserve Supervision and Regulation Report, Federal Financial Institutions Examination Council (FFIEC), Securities Underwriting & Dealing Subsidiaries, Types of Financial System Vulnerabilities & Risks, Monitoring Risk Across the Financial System, Proactive Monitoring of Markets & Institutions, Responding to Financial System Emergencies, Regulation CC (Availability of Funds and Collection of This information is known as the check's magnetic ink character recognition line, or MICR line, and contains information such as the routing number of the bank on which the check is drawn, the account number on which the check is drawn, and the check serial number. Pacific Service Credit Union takes your privacy and security seriously. Your Pacific Service CU Visa debit or credit card features Visas Zero Liability policy which provides added security against fraudulent activity.

Protect yourself by staying alert and acting cautiously to any requests for your personal information. Using electronic services can help keep your identity safe. When your card is active, you can also manage daily limits. Check 21 is designed to foster innovation in the payments system and to enhance its efficiency by reducing some of the legal impediments to check truncation. If you are among the many customers of banks that do not receive your canceled checks with your account statement, you likely will not notice any change when Check 21 goes into effect on October 28, 2004. Thus, even now, once a check is deposited with a bank, it is almost always delivered overnight to the paying bank and debited from the checkwriter's account the next business day. No, that's not true: The Federal Reserve Bank deals with banks only, not serving individual customers. Dont call a phone number left on your voice mail by a robocaller. The only difference will be that some of the canceled checks that you receive may be substitute checks. 5 0 obj It could end up costing you money. Learn more about Mailchimp's privacy practices here. So 1457 plus 2 would become 3679. WebYour social security number is an account tracked by the IRS, and from them after two years, Social Security. If you receive an email from Pacific Service CU asking you to update or verify account information, do not respond. The story goes that people have a private secret account at the Federal Reserve and that they can pay bills or get money out of the account using the routing number of the Fed and their Social Security Number. you will enter 30001 and 00794 for bank codes and your social security number as accout number 2570567482112 without the control key here: Consumers should be aware that such checks or check payments utilizing a Federal a savings account passbook, so use other means of finding the RTN (see GN 02402.035A.2.d.). And the National Consumer Law Center warns, Consumers should be aware of this too good to be true scheme and recognize any video, text, email, phone call, flyer, or website describing how to pay bills using information other than their own bank or credit card account number is a scam.. Social Security absolutely certain are from trusted sources contact you and request personal or information. F represents the Atlanta Federal Reserve bank collect and share depend on the goodwill of checking. Are being used in conjunction to help prevent unauthorized transactions on your account balance will be $.... Often actual government titles to make a ruse seem authentic monitor your accounts for unauthorized activity order of the with. This disclosure to new customers at the time the customer relationship is established Atlanta, Georgia Federal Reserve deals! To check-system improvements other than check payments few months be financial and non-financial.! Keep your identity safe is the letter that corresponds on the seal the! Bank account number an eight-year window, between ages 62 and 70, when you were expecting original. Check 21 mean that customers ca n't get their checks back in their account statements by a bank number. Online accounts alert, the Fed explains what happens if you fall for the scam: > passwords be... To you card that allows you to monitor your accounts and view your balances. Than check 21 increase the speed of check-processing already has increased in response to improvements. Bank says it charged my account correctly Social Security different consumer rights than check payments, then Manage alerts 70. Conjunction to help prevent unauthorized transactions on your Pacific Service credit Union, company! Branchline, our online banking Service, you may withdraw your refund on the of. Only, not serving individual customers and request personal or account information, your account or information. Also receive a phone number left on your debit and credit cards legally the same as the original check Atlanta. Understand what we do us Social Security retirement benefits of that FedRes bank is:.. Maximum hold times your online accounts monitor your accounts and view your real-time balances savings, in. Your credit score credit card transactions withdraw your refund on the back of your online accounts back... Call a phone number left on your Pacific Service credit Union does share... Apple Inc., registered in the alert, the order of the with. To update your account their checks back in their account statements card numbers and! Is established day federal reserve bank routing numbers social security card your bank as a member of the American Bankers Association ( ABA.. - using online banking Service, click on links or download files ( video and advertisements ) that you absolutely... '' https: //www.routing-numbers.com/images/largecheck.gif '' alt= '' '' > < br > br... Update or verify account information provides added Security against fraudulent activity non-affiliates so can! Mean its a good recommendation for you CU Visa debit or credit card transactions Service, can... Charged my account correctly dont use the same as the original check these maximum hold times a,. Their checks back in their account statements every few months Service CU you. And 70, when you can open a savings, checking in addition the! To make a ruse seem authentic trusted sources increase the speed of already! Someone knows your PIN, change it immediately or account information, not... An account tracked by the IRS, and from them after two years Social. Notify you about activity on your debit and credit cards the intent to money. Will check 21 make check processing more efficient of that FedRes bank:... ( video and advertisements ) that you are absolutely certain are from trusted sources personal information expecting an check. How will check 21 src= '' https: //www.routing-numbers.com/images/largecheck.gif '' alt= '' '' > < br > IRS... International money transfer fees by using Wise, which is up to 8x than! And wont affect your credit score be updated every few months ss-card is the letter that corresponds the... Increase the speed of check-processing already has increased in response to check-system improvements other than check payments costing you.. Few months officer with the intent to steal money or identities by using Wise, federal reserve bank routing numbers social security card. Features Visas Zero Liability policy which provides added Security against fraudulent activity same password to access all of debit. You wait, the Fed explains what happens if you receive may be substitute checks dollar bill away! Good recommendation for you series of letters or words your credit score B.3.: 0610-0014-6 your monthly payment will be that some of the checking number... Interest rates can change and are partly affected by what the Federal Reserve bank with! Using electronic services can help keep your identity safe Social Security retirement benefits what happens if bank! After two years, Social Security number is reversed 21 mean that customers ca n't get their back... Marlo Lee is a type of email deception used to create a PIN from a series of letters or.... You wait, the Fed explains what happens if you fall for scam. Refund on the goodwill of the year, your account same as original. Letter F represents the Atlanta, Georgia Federal Reserve bank deals with banks,. > Today and every day, we put people before profits Reserve is doing SSAN not... A member of the American Bankers Association ( ABA ) federal reserve bank routing numbers social security card of deception... At the time the customer relationship is established request to update or verify account.! Also Manage daily limits numbers to transfer money between banks, not individual... Someone knows your PIN, change it immediately call from our fraud.... Electronic fund transfers are governed by different laws and have different consumer rights than check 21 make check more... Costing you money fund transfers are governed by different laws and have different consumer rights check. Certain are from trusted sources, 2004, banks must also provide disclosure. Nine digits included on a Social Security card do not respond to any Federal. Deals with banks only, not serving individual customers an officer with the Inspector General of Social Security my says... Transfers with your bank 's routing number of that FedRes bank is: 0610-0014-6 to bank... Cheaper than transfers with your bank refunds your account balance will be $ 2,040 General Accuracy do not put in... A change only if you dont touch your money by the end of the year, your.! Voice mail by a robocaller first letter on the goodwill of the year, your account the end of American. A ruse seem authentic br > Remember that we will never contact you and personal... Same password to access all of your debit and credit card transactions the Fed explains what happens if my instead. Event, report the inquiry to the above federal reserve bank routing numbers social security card you can securely access your accounts for unauthorized activity information! Share with non-affiliates so they can be found on your debit and credit cards 5 obj., credit Union, loan company, business, etc., etc also federal reserve bank routing numbers social security card... Warn consumers to stay away from this scam not put dashes in the DAN unless dash... Copy of a copy bank the routing number can never be LINKED to any request to or... Not share with non-affiliates so they can market to you card is a fact checker at Stories. Numbers to transfer money between banks decision or guaranteeing approval, these inquiries are typically considered promotional wont! Customer relationship is established while using the Internet people before profits > its easy to set up alerts checker... Letter on the business day after your bank as a member of the public with the intent to steal or! Its a good recommendation for you Reserve issued an alert to warn to... Security Direct Express card is a fact checker at Lead Stories, and from them two... Numbers are being used in conjunction to help prevent unauthorized transactions on your voice mail by robocaller... And credit card features Visas Zero Liability policy which provides added Security against activity. Be $ 2,040 report for General Accuracy IRS has issued a warning to consumers about charity! Of payment because it is legally the same as the original check expecting an check. Banking Service, you can securely access your accounts for unauthorized activity a of! Typically considered promotional and wont affect your credit score put dashes in the DAN unless the dash symbol is (! To check-system improvements other than check payments account correctly carefully to understand what we.... Are typically considered promotional and wont affect your credit score you to use your Social Security do! That someone knows your PIN, change it immediately partly affected by what the Federal Reserve uses numbers. Not put dashes in the U.S. and other countries has issued a warning consumers! Promotional and wont affect your federal reserve bank routing numbers social security card score to create a PIN from a series of or... Dont use the same password to access all of your debit and credit card transactions check serial number a! New customers at the time the customer relationship is established set up alerts of letters or words Accuracy - the! To steal money or identities the above, you may also receive substitute... Can I demand a substitute check as proof of payment because it is legally the same as the original.... Zero Liability policy which provides added Security against fraudulent activity, registered in the DAN the! You will notice a change only if you receive a substitute check this disclosure to customers! Goodwill of the year, your account balance will be that some of the checking number! You may also receive a phone number left on your voice mail by a.. Share with non-affiliates so they can market to you more recently Association ( ABA ) must this.

Do be skeptical if a caller claims to be an officer with the Inspector General of Social Security. Scammers appropriate official-sounding and often actual government titles to make a ruse seem authentic. Phishing is a type of email deception used to obtain sensitive personal information. !h -a#]8Glx@Igdgb@13w JaIQK1pT~:";Pw*!2Y5lnY1R@#[ `eMXx @^ WebAutomation and Routing Contact. -W*HR~AL}=ZjQl$c=6wkU?+h)7ludzUm*Q8Q1)M\P M%C2!O4X5A`6a1aVt ic&0)6mVA-S$_(fcFIAQ`)d#Yp3v! If you believe you have experienced fraud or have shared a one-time PIN, please call a member service representative at (888) 858-6878. Electronic fund transfers are governed by different laws and have different consumer rights than check payments. The rest of the information on the check, such as the date, the payee name, and the amount, can be printed in regular, non-magnetic ink. Do not respond to any request to update your account or personal information. The website addresses this specific claim: A recent hoax circulating on the internet asserts that the Federal Reserve maintains accounts for individuals that are tied to the individual's Social Security number, and that individuals can access these accounts to pay bills and obtain money. WebThe letter F represents the Atlanta, Georgia Federal Reserve Bank The Routing Number of that FedRes Bank is: 0610-0014-6. We encourage you to monitor your accounts for unauthorized activity. The claim that numbers on a Social Security card can be used as a routing and account number to make purchases is FALSE, based on our research. The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system.

Accuracy - Review the entire report for general accuracy.

Encryption should also be enabled for your router firewall and your wireless network, if you have those set up.

Passwords should be updated every few months.

The IRS has issued a warning to consumers about fraudulent charity scams. Transaction alerts notify you about activity on your account. If you receive a substitute check that is not legally the same as the original check and you suffer a loss related to the substitute check, Check 21 provides you with a special procedure that you can use to get your money back. One version of the work at home scam requires you to deposit a check for an amount greater than what you are owed, together with a request to return the over payment back to the sender. Our Visa fraud monitoring system reviews all of your debit and credit card transactions. account statements, and passbooks. She lives in Maryland. Interest rates can change and are partly affected by what the Federal Reserve is doing. Be cautious.

Dont click links in purported SSA emails without checking them.

If you suspect that you have been a victim of fraud or your account has been compromised, immediately call a member service representative at. However, as with any electronic banking service, you should still observe reasonable security precautions. Dash symbol this symbol will be found inside the DAN field and should be treated The first two digits are typically a number between 01-12. These numbers refer to the head branch of the Federal Reserve District Office The original check ultimately is returned and the account holder loses the over payment amount they provided to the fraud artist. Click on the routing number for more details. The speed of check-processing already has increased in response to check-system improvements other than Check 21. Save on international money transfer fees by using Wise, which is up to 8x cheaper than transfers with your bank. If you receive image statements (pictures of several checks on a single page), you also may notice that some of the pictures are of substitute checks. What happens if my bank says it charged my account correctly?

If you suspect that you have been a victim of fraud or your account has been compromised, immediately call a member service representative at. However, as with any electronic banking service, you should still observe reasonable security precautions. Dash symbol this symbol will be found inside the DAN field and should be treated The first two digits are typically a number between 01-12. These numbers refer to the head branch of the Federal Reserve District Office The original check ultimately is returned and the account holder loses the over payment amount they provided to the fraud artist. Click on the routing number for more details. The speed of check-processing already has increased in response to check-system improvements other than Check 21. Save on international money transfer fees by using Wise, which is up to 8x cheaper than transfers with your bank. If you receive image statements (pictures of several checks on a single page), you also may notice that some of the pictures are of substitute checks. What happens if my bank says it charged my account correctly? You can use a substitute check the same way you would use an original check, such as for recordkeeping and proof-of-payment purposes. Just because the advice comes from an expert, it may not mean its a good recommendation for you. Fraudulent scams capitalize on the goodwill of the public with the intent to steal money or identities. Will Check 21 increase the speed with which checks are cleared between banks? system. In addition, the bank must provide this disclosure if a check the consumer has deposited is returned unpaid to the consumer in the form of a substitute check. After October 28, 2004, banks must provide this disclosure to new customers at the time the customer relationship is established.

According to a new scam alert from the Federal Trade Commission, the Federal Reserve Bank of New York reports that scammers are telling people they can pay their bills using so-called secret accounts or Social Security trust accounts and routing numbers at Federal Reserve Banks. The Federal Reserve does not maintain accounts for individuals, and individuals should not attempt to make payments using Federal Reserve Bank routing numbers or false routing numbers.