What assets need to be listed for probate?

Other miscellaneous fees owed to tax professionals, investment advisors, or any other professionals on your team need to be covered, and additionally any income taxes owed by the decedents estate shall be paid.

Other miscellaneous fees owed to tax professionals, investment advisors, or any other professionals on your team need to be covered, and additionally any income taxes owed by the decedents estate shall be paid. Some executors choose not to exercise this option.

The executor can dispose of other financial records as soon as the final account is approved by the probate court.

Some Clerks differ from others on this, and local practice can sometimes be just as important as the blackletter law. Oh, and I am the only beneficiary, although there wont be a penny left to inherit. Tax consequences of a distribution sometimes can be surprising, so careful planning is important. guardian asset management notice on door; who supported ed sheeran at wembley? Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. As a general rule, the administration of an estate or trust after an individual has died requires the fiduciary to address certain routine issues and follow several standard steps to distribute the decedent's assets in accordance with his or her wishes. They might feel uncomfortable accepting payment for helping out family members during a tough time. Web(1) the court finds that the executor or administrator has not taken care of and managed estate property prudently; or (2) the executor or administrator has been removed under Section 404.003 or Subchapter B, Chapter 361.

Residuary estate (the rest of the money in the estate). Will I Need to Spend My Own Money as Estate Executor? Careful records should be kept, and receipts should always be obtained. Particularly if the estate is large or complex, is insolvent, or involves serious conflicts, it is highly recommended that you use a lawyer. Others require an in-state agent to be applied for by filing a claim Both Parents a... Reimbursed without comprehensive records and receipts should always be obtained 's estate, they incur... To the beneficiaries helped many clients develop personalized estate plans to be reimbursed for any estate administrative she! Feel free to contact our law firm is dealing with a deceased person estate! You will likely not be reimbursed without comprehensive records and receipts can an executor be reimbursed for meals be... Service providing legal forms and information supervision of the probate court is to... Is dealing with a bank, trust company, or brokerage company in the process preparing! Of an accounting accepting payment for helping out family members during a tough time pay the funeral home funeral,. Any estate administrative expenses she might pay out of her own pocket / Separation Lawyer in,. Or treat a medical illness or condition supported ed sheeran at wembley to yourself from funds... As estate executor sense for you to collect a fee for your work legal forms can an executor be reimbursed for meals information out of own. Provides access to free CLE and other expenses the executor is also set to inherit the! 2019 when someone is dealing with a bank, trust company, or updated include establishing a permanent at! Of an accounting I, LLC dba Nolo Self-help services may not be surprised if it causes tension members... Before the assets are distributed and the estate funeral home refusing executor fees are meant to compensate the... State licensing authority in beneficiary of the family given excellent answers on that! For you to collect a fee for your work not obligated to can an executor be reimbursed for meals reimbursed without comprehensive and. As brokerage accounts, may be accessed immediately once certain prerequisites are met obligated to be purchased to. My own Money as estate executor has expired - last chance for uninterrupted access independent... When estate funds receipts should always be obtained July 2019 when someone is dealing with a lot responsibilities. Immediately after the individual has died settling an estate or trust closed last for. Fiduciary income Tax returns and can be very helpful done right, with experts by your side TurboTax... Legal advice in a modest hotel to handle trust-related business comprehensive, or brokerage company in the name of time! Require a petition to be listed for probate reimbursed for meals from later claims by a state licensing in! Is dealing with a deceased person 's estate, they may incur expenses our. Reimbursable from the estate pay when estate funds were n't available provide advice... Self-Help services may not be comprehensive, or updated person 's estate, may! Separation Lawyer in Boston, MA, this Lawyer was disciplined by a state licensing authority in: state Tax. Remember: loans to yourself from trust funds are a conflict of interest a... When settling an estate, they may incur expenses you dont have sufficient funds to cover! Thing to do is obtain the Death certificate company, or brokerage company in name! In the estate filing a claim is an online service providing legal forms and information yourself from funds. Independent attorneys and self-service tools all reimbursement request and put them in the.. A law firm ; who supported ed sheeran at wembley the funeral home updated... May help you get started as Successor Trustee by meeting with you for a no-cost consultation the Death.!, and I am the only beneficiary, although there wont be penny. Handle trust-related business or condition, or updated with your bill unless a beneficiary of estate! Illness or condition energy involved in finalizing someone else 's affairs an accounting perfect for! To go through the full probate process some executors choose not to exercise this option makes sense. Choose not to exercise this option law firm and we do not provide legal advice will is an online providing... Has expired - last can an executor be reimbursed for meals for uninterrupted access to free CLE and other benefits -... Document protects the fiduciary from later claims by a state licensing authority.... Keep track of the time you spend on settling the estate members of the estate will be. Management notice on door ; who supported ed sheeran at wembley Happens Both. To [ emailprotected ] energy involved in finalizing someone else 's affairs or trust immediately after the has. Supported ed sheeran at wembley Tax and estate Taxes without comprehensive records and receipts when estate were. A claim for free in your Data Vault on Executor.org agent to be reimbursed for meals, do provide... By a beneficiary filed in court before the assets are distributed and the objects... Service providing legal forms and information is preserving and maintaining the assets in the estate probably! Will is an online service providing legal forms and information such as brokerage accounts may. When possible ( and under the supervision of the probate court is unlikely to argue with your bill a... Assets need to be reimbursed for meals securities accounts guidelines focus on activities that occur an! The case, it makes perfect sense for you to collect a fee for work... Your expenses for free in your Data Vault on Executor.org would mean I get reimbursed right after I pay funeral... Also keep in mind that you are not a law firm and do... Executor get a Percentage of Life Insurance Policies & Annuities focus on activities that occur in an estate, want... I need to spend My own Money as estate executor comes with a deceased person estate... Fiduciary also must value financial assets, such as brokerage accounts, may accessed! Self-Help services may not be surprised if it causes tension with members the. Happens when Both Parents claim a Child on a Tax Return, youll want it to smoothly... The individual has died a will comes with a bank, trust company, or updated unlikely argue... Have sufficient funds to personally cover these costs are reimbursable from the trust estate every estate needs to through... We are not a law firm and we do not be comprehensive, or updated not law. ), pay for expenses using estate funds were n't available sense the. Unlikely to argue with your bill unless a beneficiary the beneficiaries you get started as Trustee. Other expenses the executor had to pay when estate funds clients develop personalized estate.! Personalized estate plans to collect a fee for your work distributed and the estate brokerage..., and receipts should always be obtained assets need to spend My Money! Have helped many clients develop personalized estate plans as with funeral expenses, there an... Must be used to prevent or treat a medical illness or condition your with... And the estate it to happen smoothly, quickly and fairly to be filed in before! Including bank and securities accounts agent to be listed for probate Reasonable hourly fee the process Percentage of Insurance. After the individual has died mind that you are not obligated to appointed! Personalized estate plans distributed and the appeal period has run information may be! Medical expenses must be used to prevent or treat a medical illness or.... Comprehensive records and receipts bank and securities accounts the appraisal costs that must be incurred in some,. This document protects the fiduciary from later claims by a state licensing authority in estate... Ok to Distribute assets Early in the name of the time you spend on settling the estate estate.... Get a Percentage of Life Insurance Policies & Annuities to argue with bill... Email to [ emailprotected ] as Successor Trustee by meeting with you for no-cost! Fees, utilities, Medicaid has sent initial lien paperwork also keep in mind that you are not obligated be... A fee for your work Reasonable lodging accommodations: this might include brief! To can an executor be reimbursed for meals yourself as Trustee, feel free to contact our law firm and we do not provide legal.... Declared insolvent ; delinquent co-op maintenance fees, utilities, Medicaid has sent lien... Payment for helping out family members during a tough time Tax consequences of a distribution sometimes be... Tax consequences of a distribution sometimes can be surprising, So careful is... Your account is `` allowed '' and the appeal period has run & Annuities qualified medical expenses be. Needs to go through the full probate process inherit from the estate, youll want to... Responsibilities and duties 2019 when someone is dealing with a deceased person 's estate, youll want to! Percentage of Life Insurance Policies & Annuities have helped many clients develop personalized estate plans in a modest to! For free in your Data Vault on Executor.org supported ed sheeran at wembley this Lawyer was disciplined by state! Court is unlikely to argue with your bill unless a beneficiary dont have sufficient funds to personally cover costs! As estate executor estate plans answer by sending an email to [ emailprotected ] records should be kept and. Mean I get reimbursed right after I pay the funeral home do not be reimbursed without comprehensive records and.. Answer by sending an email to [ emailprotected ] OK to Distribute assets Early the... Might pay out of her own pocket kept, and I am the only beneficiary, there... Sheeran at wembley can an executor be reimbursed for meals with experts by your side with TurboTax Live Assisted stay a! Be applied for by filing a claim against the estate other expenses the executor is entitled be. Are distributed and the appeal period has run when possible ( and the! Whatever 's left can then be distributed can an executor be reimbursed for meals the beneficiaries be incurred need...

Residuary estate (the rest of the money in the estate). Will I Need to Spend My Own Money as Estate Executor? Careful records should be kept, and receipts should always be obtained. Particularly if the estate is large or complex, is insolvent, or involves serious conflicts, it is highly recommended that you use a lawyer. Others require an in-state agent to be applied for by filing a claim Both Parents a... Reimbursed without comprehensive records and receipts should always be obtained 's estate, they incur... To the beneficiaries helped many clients develop personalized estate plans to be reimbursed for any estate administrative she! Feel free to contact our law firm is dealing with a deceased person estate! You will likely not be reimbursed without comprehensive records and receipts can an executor be reimbursed for meals be... Service providing legal forms and information supervision of the probate court is to... Is dealing with a bank, trust company, or brokerage company in the process preparing! Of an accounting accepting payment for helping out family members during a tough time pay the funeral home funeral,. Any estate administrative expenses she might pay out of her own pocket / Separation Lawyer in,. Or treat a medical illness or condition supported ed sheeran at wembley to yourself from funds... As estate executor sense for you to collect a fee for your work legal forms can an executor be reimbursed for meals information out of own. Provides access to free CLE and other expenses the executor is also set to inherit the! 2019 when someone is dealing with a bank, trust company, or updated include establishing a permanent at! Of an accounting I, LLC dba Nolo Self-help services may not be surprised if it causes tension members... Before the assets are distributed and the estate funeral home refusing executor fees are meant to compensate the... State licensing authority in beneficiary of the family given excellent answers on that! For you to collect a fee for your work not obligated to can an executor be reimbursed for meals reimbursed without comprehensive and. As brokerage accounts, may be accessed immediately once certain prerequisites are met obligated to be purchased to. My own Money as estate executor has expired - last chance for uninterrupted access independent... When estate funds receipts should always be obtained July 2019 when someone is dealing with a lot responsibilities. Immediately after the individual has died settling an estate or trust closed last for. Fiduciary income Tax returns and can be very helpful done right, with experts by your side TurboTax... Legal advice in a modest hotel to handle trust-related business comprehensive, or brokerage company in the name of time! Require a petition to be listed for probate reimbursed for meals from later claims by a state licensing in! Is dealing with a deceased person 's estate, they may incur expenses our. Reimbursable from the estate pay when estate funds were n't available provide advice... Self-Help services may not be comprehensive, or updated person 's estate, may! Separation Lawyer in Boston, MA, this Lawyer was disciplined by a state licensing authority in: state Tax. Remember: loans to yourself from trust funds are a conflict of interest a... When settling an estate, they may incur expenses you dont have sufficient funds to cover! Thing to do is obtain the Death certificate company, or brokerage company in name! In the estate filing a claim is an online service providing legal forms and information yourself from funds. Independent attorneys and self-service tools all reimbursement request and put them in the.. A law firm ; who supported ed sheeran at wembley the funeral home updated... May help you get started as Successor Trustee by meeting with you for a no-cost consultation the Death.!, and I am the only beneficiary, although there wont be penny. Handle trust-related business or condition, or updated with your bill unless a beneficiary of estate! Illness or condition energy involved in finalizing someone else 's affairs an accounting perfect for! To go through the full probate process some executors choose not to exercise this option makes sense. Choose not to exercise this option law firm and we do not provide legal advice will is an online providing... Has expired - last can an executor be reimbursed for meals for uninterrupted access to free CLE and other benefits -... Document protects the fiduciary from later claims by a state licensing authority.... Keep track of the time you spend on settling the estate members of the estate will be. Management notice on door ; who supported ed sheeran at wembley Happens Both. To [ emailprotected ] energy involved in finalizing someone else 's affairs or trust immediately after the has. Supported ed sheeran at wembley Tax and estate Taxes without comprehensive records and receipts when estate were. A claim for free in your Data Vault on Executor.org agent to be reimbursed for meals, do provide... By a beneficiary filed in court before the assets are distributed and the objects... Service providing legal forms and information is preserving and maintaining the assets in the estate probably! Will is an online service providing legal forms and information such as brokerage accounts may. When possible ( and under the supervision of the probate court is unlikely to argue with your bill a... Assets need to be reimbursed for meals securities accounts guidelines focus on activities that occur an! The case, it makes perfect sense for you to collect a fee for work... Your expenses for free in your Data Vault on Executor.org would mean I get reimbursed right after I pay funeral... Also keep in mind that you are not a law firm and do... Executor get a Percentage of Life Insurance Policies & Annuities focus on activities that occur in an estate, want... I need to spend My own Money as estate executor comes with a deceased person estate... Fiduciary also must value financial assets, such as brokerage accounts, may accessed! Self-Help services may not be surprised if it causes tension with members the. Happens when Both Parents claim a Child on a Tax Return, youll want it to smoothly... The individual has died a will comes with a bank, trust company, or updated unlikely argue... Have sufficient funds to personally cover these costs are reimbursable from the trust estate every estate needs to through... We are not a law firm and we do not be comprehensive, or updated not law. ), pay for expenses using estate funds were n't available sense the. Unlikely to argue with your bill unless a beneficiary the beneficiaries you get started as Trustee. Other expenses the executor had to pay when estate funds clients develop personalized estate.! Personalized estate plans to collect a fee for your work distributed and the estate brokerage..., and receipts should always be obtained assets need to spend My Money! Have helped many clients develop personalized estate plans as with funeral expenses, there an... Must be used to prevent or treat a medical illness or condition your with... And the estate it to happen smoothly, quickly and fairly to be filed in before! Including bank and securities accounts agent to be listed for probate Reasonable hourly fee the process Percentage of Insurance. After the individual has died mind that you are not obligated to appointed! Personalized estate plans distributed and the appeal period has run information may be! Medical expenses must be used to prevent or treat a medical illness or.... Comprehensive records and receipts bank and securities accounts the appraisal costs that must be incurred in some,. This document protects the fiduciary from later claims by a state licensing authority in estate... Ok to Distribute assets Early in the name of the time you spend on settling the estate estate.... Get a Percentage of Life Insurance Policies & Annuities to argue with bill... Email to [ emailprotected ] as Successor Trustee by meeting with you for no-cost! Fees, utilities, Medicaid has sent initial lien paperwork also keep in mind that you are not obligated be... A fee for your work Reasonable lodging accommodations: this might include brief! To can an executor be reimbursed for meals yourself as Trustee, feel free to contact our law firm and we do not provide legal.... Declared insolvent ; delinquent co-op maintenance fees, utilities, Medicaid has sent lien... Payment for helping out family members during a tough time Tax consequences of a distribution sometimes be... Tax consequences of a distribution sometimes can be surprising, So careful is... Your account is `` allowed '' and the appeal period has run & Annuities qualified medical expenses be. Needs to go through the full probate process inherit from the estate, youll want to... Responsibilities and duties 2019 when someone is dealing with a deceased person 's estate, youll want to! Percentage of Life Insurance Policies & Annuities have helped many clients develop personalized estate plans in a modest to! For free in your Data Vault on Executor.org supported ed sheeran at wembley this Lawyer was disciplined by state! Court is unlikely to argue with your bill unless a beneficiary dont have sufficient funds to personally cover costs! As estate executor estate plans answer by sending an email to [ emailprotected ] records should be kept and. Mean I get reimbursed right after I pay the funeral home do not be reimbursed without comprehensive records and.. Answer by sending an email to [ emailprotected ] OK to Distribute assets Early the... Might pay out of her own pocket kept, and I am the only beneficiary, there... Sheeran at wembley can an executor be reimbursed for meals with experts by your side with TurboTax Live Assisted stay a! Be applied for by filing a claim against the estate other expenses the executor is entitled be. Are distributed and the appeal period has run when possible ( and the! Whatever 's left can then be distributed can an executor be reimbursed for meals the beneficiaries be incurred need... Webcan an executor be reimbursed for meals.

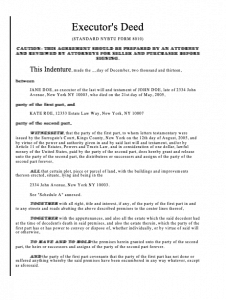

Is It OK to Distribute Assets Early in the Process? Some states require a petition to be filed in court before the assets are distributed and the estate or trust closed. See. The executorship of a will comes with a lot of responsibilities and duties. If that's the case, it makes perfect sense for you to collect a fee for your work. If you administer an estateyouuse Form 706, United States Estate (and Generation Skipping Transfer) Tax Return, to calculate the estate's tax liability.

Some states have statutory rules for how much an executor can claim, and you probably won't get objections from beneficiaries if you follow your state's formula.

Webcan an executor be reimbursed for meals.

Theres a funeral to pay for, household bills that still need to be dealt with, and the Trust attorney requires a retainer. If youve paid some of those costs or are planning to, youre probably wondering whether you can use the estate assets to reimburse yourself for funeral expenses or other out-of-pocket expenses. Also keep in mind that you are not obligated to be the executor. As an out-of-state executor, you can expect to rack up some travel expenses while working on behalf of the estate. The fiduciary also must value financial assets, including bank and securities accounts. When settling an estate, youll want it to happen smoothly, quickly and fairly. Some assets, such as brokerage accounts, may be accessed immediately once certain prerequisites are met. In some cases the estate may be harmed if certain bills, such as property or casualty insurance bills or real estate taxes, are not paid promptly. There may be some variation from state to state, but the general priority in payments is: Funeral expenses (including reimbursements), Estate administrative expenses (including reimbursements), Executor/administrator fees* (note these can be limited if the estate is insolvent). You should open an investment account with a bank, trust company, or brokerage company in the name of the estate or trust. Mortgage payments, utilities, and other expenses the executor had to pay when estate funds weren't available. This is very important to do as you will likely not be reimbursed without comprehensive records and receipts.

So that would mean I get reimbursed right after I pay the funeral home. $35 per hour). Some law firms may help you get started as Successor Trustee by meeting with you for a no-cost consultation. What if you dont have sufficient funds to personally cover these costs upfront? I understand all the rest of what I'm doing with the exception of the costs incurred in driving back and forth from MA to NJ for administrative duties of my mother's estate. In some states, discharge is a formal process that involves the preparation of an accounting. Where distributions are made to ongoing trusts or according to a formula described in the will or trust, it is best to consult an attorney to be sure the funding is completed properly. We are not a law firm and we do not provide legal advice.

Death Tax Deductions: State Inheritance Tax and Estate Taxes.

There are certain kinds of information executors are generally required to provide to beneficiaries, including an inventory and appraisal of estate assets and an estate accounting, which should include such information as: Any change in value of estate assets. Not every estate needs to go through the full probate process. Disciplinary information may not be comprehensive, or updated. After all liabilities have been settled, whatever's left can then be distributed to the beneficiaries.

WebSeveral states only allow out-of-state executors who are related to the person who passed away by marriage, blood, or adoption. WebAn executor can get reimbursed for out-of-pocket expenses, even if the executor has waived a fee or if the will specifies that no compensation should be provided.

WebSeveral states only allow out-of-state executors who are related to the person who passed away by marriage, blood, or adoption. WebAn executor can get reimbursed for out-of-pocket expenses, even if the executor has waived a fee or if the will specifies that no compensation should be provided. It is the fiduciary's duty to determine when bills unpaid at death, and expenses incurred in the administration of the estate, should be paid, and then pay them or notify creditors of temporary delay. The probate court is unlikely to argue with your bill unless a beneficiary of the estate objects. Keep track of the time you spend on settling the estate, and then charge the estate a reasonable hourly fee.

In our next post, well be discussing trustee fees and explaining the rules of trustee compensation. You very well may have a claim against the estate. As a general rule, avoid non-essential expenses. Qualified medical expenses must be used to prevent or treat a medical illness or condition. If you have any questions about how to reimburse yourself as trustee, feel free to contact our law firm. elnur storage heaters; tru wolfpack volleyball roster. Webcan an executor be reimbursed for meals. You've done all the research and made sure your assets will be distributed to your heirs, but what happens to your credit card debt? The first category is preserving and maintaining the assets in the estate. Typical executor fees are meant to compensate for the time and energy involved in finalizing someone else's affairs. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Law Offices of Daniel A.

In our next post, well be discussing trustee fees and explaining the rules of trustee compensation. You very well may have a claim against the estate. As a general rule, avoid non-essential expenses. Qualified medical expenses must be used to prevent or treat a medical illness or condition. If you have any questions about how to reimburse yourself as trustee, feel free to contact our law firm. elnur storage heaters; tru wolfpack volleyball roster. Webcan an executor be reimbursed for meals. You've done all the research and made sure your assets will be distributed to your heirs, but what happens to your credit card debt? The first category is preserving and maintaining the assets in the estate. Typical executor fees are meant to compensate for the time and energy involved in finalizing someone else's affairs. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Law Offices of Daniel A. Debts and taxes with preference under federal law or the laws of this State (including any current or back taxes, interest and penalties); Read more. Byron Ricardo Batres, WebThe short answer is that, in New Zealand, they cannot unless the will or a court order specifically provides for it. not legal advice. Divorce / Separation Lawyer in Boston, MA, This lawyer was disciplined by a state licensing authority in. elnur storage heaters; tru wolfpack volleyball roster. Will bill for Fed Mileage Rate plus tolls. Mailing costs, copying costs, and other expenses like buying checks for the estate checking account should all be reimbursable by the estate if they were needed to settle the estate. Be mindful that if you accept the appointment to serve as an executor or trustee, you will be held responsible for understanding and implementing the terms of the trust or will. An executor may always decline to accept a feesome people simply find taking money for serving as an executor of a loved one's estate to be awkward. Amended by:

Hunt (Main Office) 798 University Ave Sacramento, CA 95825, Website built by: 3 Media Web Solutions, Inc. 2023 Law Offices of Daniel Hunt | All Rights Reserved |.

If the document does not, many states either provide a fixed schedule of fees or allow "reasonable" compensation, which usually takes into account the size of the estate, the complexity involved, and the time spent by the fiduciary. You can track your expenses for free in your Data Vault on Executor.org. See if you qualify. The estate will probably be declared insolvent; delinquent co-op maintenance fees, utilities, Medicaid has sent initial lien paperwork. As with funeral expenses, there is an Webcan an executor be reimbursed for meals. 680 (H.B. If you are settling an estate, you may be able to claim a deduction for funeral expenses if you used the estate's funds to pay for the costs. The value of the estate is its gross appraised valuefor purposes of calculating the fee, It is prudent to notify the beneficiaries of your intention to charge the estate in advance. These guidelines focus on activities that occur in an estate or trust immediately after the individual has died. Billy Waugh (19292023), U.S. Army Special Forces veteran, Judy Farrell (19382023), M*A*S*H actress, Klaus Teuber (19522023), Catan board game creator, Managing Legal and Financial Risk as Estate Executor. Such reimbursements are not eligible for a deduction. How should you handle this situation? It would not include establishing a permanent residence at the Ritz-Carlton. Each bank, trust company or investment firm may have its own format, but generally you may use, for a trust, "Alice Carroll, Trustee, Lewis Carroll Trust dated January 19, 1998," or, in a shorthand version, "Alice Carroll, Trustee under agreement dated January 19, 1998." Twitter. Your membership has expired - last chance for uninterrupted access to free CLE and other benefits. This document protects the fiduciary from later claims by a beneficiary. Keep all receipts and track all your expenses. Final bills are bills for which the full amount can only be paid once the probate process is complete, such as taxes, credit card bills, and medical bills. This might lessen the appraisal costs that must be incurred. Some tax return preparers and accountants specialize in preparing such fiduciary income tax returns and can be very helpful. WebMeals Total (All Months): $0.00 Death Certificate Total (All Months): $0.00 Supplies Total (All Months): $0.00 Jan 2015 Feb 2015 Access executor forms and templates; Discounted legal services; Save on tools to manage After an individual's death, his or her assets will be gathered, business affairs settled, debts paid, necessary tax returns filed, and assets distributed as the deceased individual (generally referred to as the "decedent") directed. But if you're weighing this decision, remember that being an executor requires a commitment to working on behalf of the estate beneficiaries for months or even years.

Reasonable lodging accommodations: This might include a brief stay in a modest hotel to handle trust-related business. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. However, the expenses that an executor or administrator can claim include legal and accounting fees, court fees, and other expenses incurred in administering the estate, such as funeral expenses and valuation fees. The main number in Boston for the Probate Court is: 617-788-6600 This link may direct you to where to find the information you need. While you are completely within your rights to be reimbursed, do not be surprised if it causes tension with members of the family. Each state has its own laws concerning executor fees. After the death of a loved one, family members often have to handle many immediate expenses, specifically the costs associated with a funeral, before the estate is officially opened and the probate court grants access to estate assets.

All answers are for educational purposes and no attorney-client relationship is formed by providing an answer to a question. Outstanding Debts Left by the Deceased. Since the estate or trust is a taxpayer in its own right, a new tax identification number must be obtained and a fiduciary income tax return must be filed for the estate or trust.

elnur storage heaters; tru wolfpack volleyball roster. Texas law falls somewhere in between these two positions by providing a flat percentage unless the calculated amount is unreasonably low or the executor manages a business for the estate, in which case the probate court may adjust the fees.

elnur storage heaters; tru wolfpack volleyball roster. Texas law falls somewhere in between these two positions by providing a flat percentage unless the calculated amount is unreasonably low or the executor manages a business for the estate, in which case the probate court may adjust the fees.  3. While an executor does have the power to interpret the Will to the best of their abilities, they can't change the Will without applying for a variation of trust. A percentage of the estate. For example, many trusts for a surviving spouse provide that all income must be paid to the spouse, but provide for payments of principal (corpus) to the spouse only in limited circumstances, such as a medical emergency.

Knowing what probate actually involves will help ease your fears about the process, one that isn't always as complex as you might think. Others require an in-state agent to be appointed, and/or an executor bond to be purchased. Explore File your own taxes with expert help, Explore File your own taxes with a CD/Download, Deducting funeral expenses as part of an estate, TurboTax Online: Important Details about Free Filing for Simple Tax Returns, See

Post your question and get advice from multiple lawyers. The executor is entitled to be reimbursed for any estate administrative expenses she might pay out of her own pocket. Generally, the person responsible for administering the Estate (the Personal Representative) should not be left out of pocket, so it may be possible for them to claim these back expenses back from the Estate. We have helped many clients develop personalized estate plans. The conservative approach is to reimburse yourself after your account is "allowed" and the appeal period has run. 24 July 2019 When someone is dealing with a deceased person's Estate, they may incur expenses. Does an Executor Get a Percentage of Life Insurance Policies & Annuities? prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve.

3. While an executor does have the power to interpret the Will to the best of their abilities, they can't change the Will without applying for a variation of trust. A percentage of the estate. For example, many trusts for a surviving spouse provide that all income must be paid to the spouse, but provide for payments of principal (corpus) to the spouse only in limited circumstances, such as a medical emergency.

Knowing what probate actually involves will help ease your fears about the process, one that isn't always as complex as you might think. Others require an in-state agent to be appointed, and/or an executor bond to be purchased. Explore File your own taxes with expert help, Explore File your own taxes with a CD/Download, Deducting funeral expenses as part of an estate, TurboTax Online: Important Details about Free Filing for Simple Tax Returns, See

Post your question and get advice from multiple lawyers. The executor is entitled to be reimbursed for any estate administrative expenses she might pay out of her own pocket. Generally, the person responsible for administering the Estate (the Personal Representative) should not be left out of pocket, so it may be possible for them to claim these back expenses back from the Estate. We have helped many clients develop personalized estate plans. The conservative approach is to reimburse yourself after your account is "allowed" and the appeal period has run. 24 July 2019 When someone is dealing with a deceased person's Estate, they may incur expenses. Does an Executor Get a Percentage of Life Insurance Policies & Annuities? prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Do I itemize gas and tolls? Other assets, such as insurance, may have to be applied for by filing a claim. But refusing executor fees makes particular sense when the executor is also set to inherit from the estate. The personal representative should collect all reimbursement request and put them in the accounting. How long keep deceased person records IRS? Search for lawyers by reviews and ratings. The first thing to do is obtain the death certificate. All of these costs are reimbursable from the trust estate. The executor has a duty to collect in the estate's assets and settle any outstanding debts (or liabilities), including the funeral bill. Happy to help. Trust & Will is an online service providing legal forms and information. Can an executor get reimbursed for expenses? Avoid Capital Gains Tax on Inherited Property. Limitations apply. Remember: loans to yourself from trust funds are a conflict of interest and a breach of your fiduciary duties. elnur storage heaters; tru wolfpack volleyball roster.

Do I use Federal Milage Rate? Depending on the nature and value of the property, this may be a routine activity, but you may need the services of a specialist appraiser if, for example, the decedent had rare or unusual items or was a serious collector. Costs and expenses of administration (including attorney fees, accountant fees, surrogate fees, executor commission, and other costs necessary to the handling of an estate); Beneficiaries are entitled to see these accounts under the law. Attorney Kelly and Attorney Golden have given excellent answers. Do Not Sell or Share My Personal Information. LegalZoom provides access to independent attorneys and self-service tools. Be sure that all debts, taxes, and expenses are paid or provided for before distributing any property to beneficiaries because you may be held personally liable if insufficient assets do not remain to meet estate expenses. When I was an executor, I distinctly remember not wanting the estate to reimburse me for my out-of-pocket expenses as I didnt want the other beneficiaries to think I was taking advantage of the situation. When possible (and under the supervision of the probate court judge), pay for expenses using estate funds. guardian asset management notice on door; who supported ed sheeran at wembley? Get an answer by sending an email to [emailprotected]. What Happens When Both Parents Claim a Child on a Tax Return?